Return-hungry investors are always on the lookout for stocks that can offer value and at the same time promise future growth which remains elusive in most of the companies that have rallied in the past year.

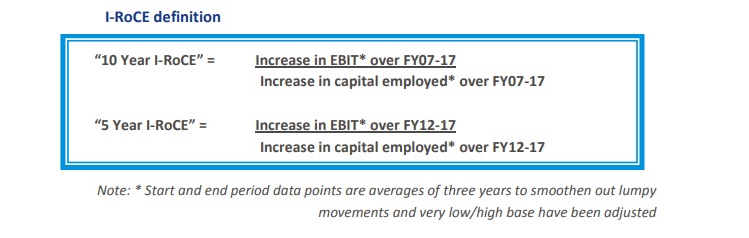

To answer this, Edelweiss Securities in its second edition of Capital Conundrum series, handpicked 20 stocks based on incremental return on capital employed (I-RoCE) framework, which according to them, is a true reflection of the management ability to redeploy incremental capital at higher returns that is not clouded by past capital allocation decisions.

According to Edelweiss Securities, I-RoCE is more crucial than reported RoCE as it better reflects the management’s fresh capital allocation decisions and forms the crux of their efficiency test.

date = new Date(); date.setTime(date.getTime()+(1*24*60*60*1000)); $.cookie("dfp_cookie_article", "Y1", {expires: date,path:"/",domain: ".moneycontrol.com"});Further, I-RoCE companies can be categorised into two buckets: a) Evergreen – Companies improving or sustaining their high RoCE and b) Rising Stars–Companies with low historical RoCE, but moving up the curve.

date = new Date(); date.setTime(date.getTime()+(1*24*60*60*1000)); $.cookie("dfp_cookie_article", "Y1", {expires: date,path:"/",domain: ".moneycontrol.com"});related news

Maruti Suzuki Q4 net profit rises 10% at Rs 1,882 cr, misses Street estimates

Apple iTunes finally launched on Microsoft Store, tech giants resolve all compatibility issues

Moneycontrol Ultimate Business Quiz #24: Test your knowledge

What are 'Evergreen' and 'Rising Star' categories?

Evergreen: This category includes companies which are improving or sustaining high RoCE. The thumb rule is that RoCE should be greater than 20 percent of the 10-year average. Evergreen companies that have delivered & sustained high I-RoCE are rewarded by markets.

Under the Evergreen category, the companies which qualify the above criteria include names like Britannia Industries, Eicher, Pidilite Industries, Avanti Feeds, La Opala, TVS Srichakra Ltd, Atul, Kajaria, Sheela, and MRF.

Rising Stars: This category includes companies with low historical RoCE which is usually less than 20 percent of 10-year average, but are moving up the curve. Rising Stars are expected to emerge as winners going ahead and create substantial shareholders wealth.

The companies that make the list under the Rising Stars category includes TVS Motors, D-Mart, Heritage Foods, KPR Mills, CCL Products, Finolex Cables, Phoenix, Firstsource Solutions, Vardhman, and Nilkamal, said the Edelweiss report.

There are also companies that have moved from the Rising Stars category to the Evergreen category in the last five years. The probability of a Rising Star company moving to the Evergreen category in the following years, based on past five years』 back-testing analysis, is 40 percent, added the report.

本文來源:https://www.moneycontrol.com/news/business/markets/these-20-evergreen-companies-rising-stars-stocks-are-your-best-bet-to-make-a-multibagger-portfolio-2558843.html